Global Market Comments

August 11, 2009

Featured Trades: (NATURAL GAS), (UNG), (BYD)

August 11, 2009

Featured Trades: (NATURAL GAS), (UNG), (BYD)

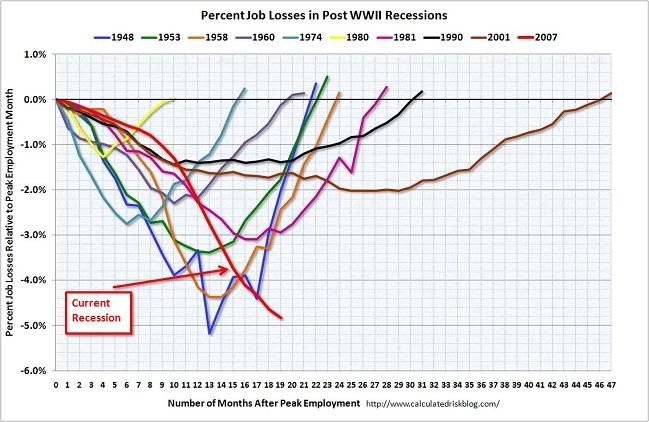

1)Welcome to the “square root” shaped recovery. That is the likely

shape of the recovery curve we can expect over the coming years. If you

back out what I call the “2000’s fluff” of excess car production, liar

loans, using the home ATM for serial, annual refinancings, excess

consumption, unneeded home construction to account for the new

frugality, US GDP growth drops by 1%. Chop off another 1% for

deleveraging in all its forms, including lower leverage ratios, the end

of the collaterized debt markets and credit default swaps, ultra high

junk yields, bond ratings for sale, and the new conservatism of CFO’s

and auditors. That leaves you with the 1% growth rate that Japan has

seen for the last 20 years. That means falling standard of livings, an

unemployment rate permanently stuck at German style double digits,

endemic deflation, a collapsing dollar, a comatose real estate market,

and moribund stock markets. Where are the 37 million jobs going to come

from that American needs over the next decade? If your kid is going to

graduate from college soon, or cash out from the army, he better start

learning Mandarin.

3% Average US GDP growth rate 2002-2007

-1% Bank deleveraging

-1% 2000’s fluff-liar loans, excess home construction, excess car production

-1% real GDP growth 2010-2020

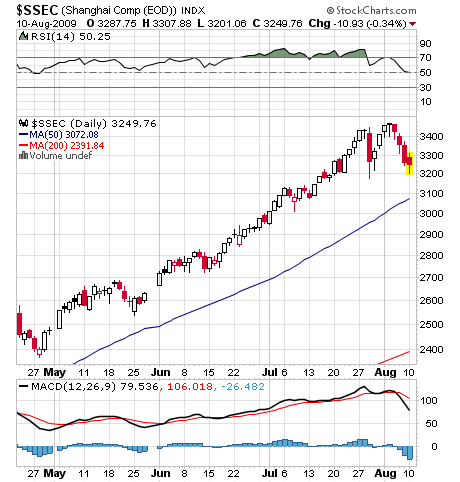

2) Car sales are soaring by 48% to a 12 million unit annual rate.

Consumer spending is exploding. Property is going crazy, with prices

and volumes back to all time highs. The bubble is back. No, I’m not

talking about the US, dummy, it’s China. I’m amazed that the Middle

Kingdom’s car sales have exceed those of the US for the first time in

history without a peep from the press, a feat that Germany and Japan

were never able to pull off. It just shows how much time we are wasting

gazing at our own navel. Too bad they don’t have enough roads to drive

them on. The big question is how long until China take over the world

market? See my earlier piece on BYD Motors atwww.madhedgefundtrader.com/

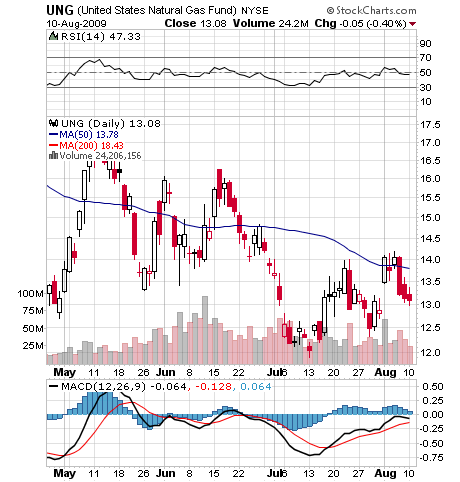

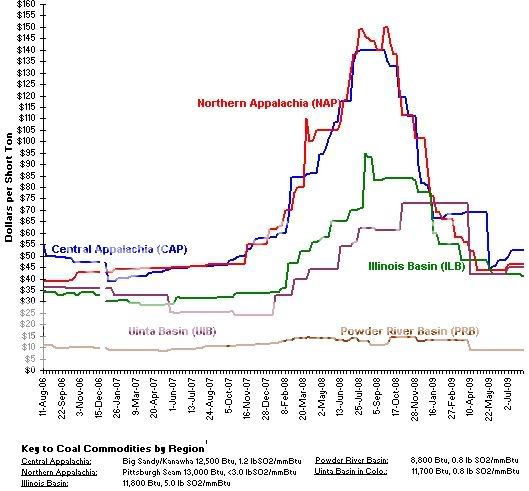

3) I ran some numbers today and came to the staggering conclusion that

at $3.60/BTU, natural gas is now cheaper than coal in some markets. One

ton of high grade Pennsylvania anthracite costs $65/ton. Some 18

million BTU’s of natural gas, the energy equivalent, costs $66, and

doesn’t give you black lung, asthma, lung cancer, polluted air, and

mountains of ash. The BTU equivalent of crude comes in at $210, and

high test gasoline at an extortionate $420. The crude/NG ratio is at

19:1, an all time high, and an entire generation of ratio traders has

been wiped out. It’s just another one of those six standard deviation

events which seem to be happening constantly. And like a rubbernecker

driving past a gory accident where the human organs are draped over

the detailing, I am always interested in wipe outs. Yes, I saw the

movie Crash. Don’t ask. Why aren’t the power companies jumping in and

burning gas instead of coal? There is the minor issue in that the

industry needs $500 billion and ten years to build the plants to take

advantage of the enormous new supply. So only frenetic production cuts

will support the price until then, which are accelerating as you read

this. Or a major hurricane. Better keep UNG on your screen and buy the

next wash out.

4) The US Postal Service, the largest civilian government employer in

the country, is getting flayed by a pack of feral dogs. After cutting

$6 billion in costs this year by shortening hours, layoffs, and closing

branches, it still looks to lose $7 billion. The General Accounting

Office says that first class mail volumes have had their greatest fall

since the Great Depression I, dropping by half, and few send out junk

mail in a recession. Next on the chopping block is Saturday deliveries

to save another $3 billion. Naysayers argue that hard times for the

service is proof the government can’t manage anything, including health

care. Hellooooo! Have these people heard of e-mail? If the Boston

Globe, the Rocky Mountain News, and the San Francisco Chronicle are

getting gutted by the Internet, why not the post office? My investment

advice? Load up on nondenominated first class postage stamps, which

have already increased in value from 42 to 44 cents since December, a

gain of 5%. The last time I checked, it cost $8.25 to send a letter via

Fedex. Postage rates are going up large.

QUOTE OF THE DAY

“Without exception, no one I know is long term bullish,” said Michael

Steinhart, one of the founders of the hedge fund industry, and an early

backer of the Wisdom Tree family of ETF’s.

No comments:

Post a Comment